Zirconia Ceramic Additive Manufacturing in 2025: Unleashing Next-Gen Performance and Market Expansion. Explore How Advanced 3D Printing is Transforming High-Precision Industries Over the Next Five Years.

- Executive Summary: Key Trends and Market Drivers in 2025

- Market Size, Growth Rate, and Forecasts to 2030

- Technological Innovations in Zirconia Ceramic 3D Printing

- Competitive Landscape: Leading Players and Strategic Initiatives

- Applications Across Medical, Aerospace, and Industrial Sectors

- Supply Chain Dynamics and Raw Material Sourcing

- Regulatory Environment and Industry Standards

- Challenges: Technical Barriers and Adoption Hurdles

- Sustainability and Environmental Impact

- Future Outlook: Opportunities and Strategic Recommendations

- Sources & References

Executive Summary: Key Trends and Market Drivers in 2025

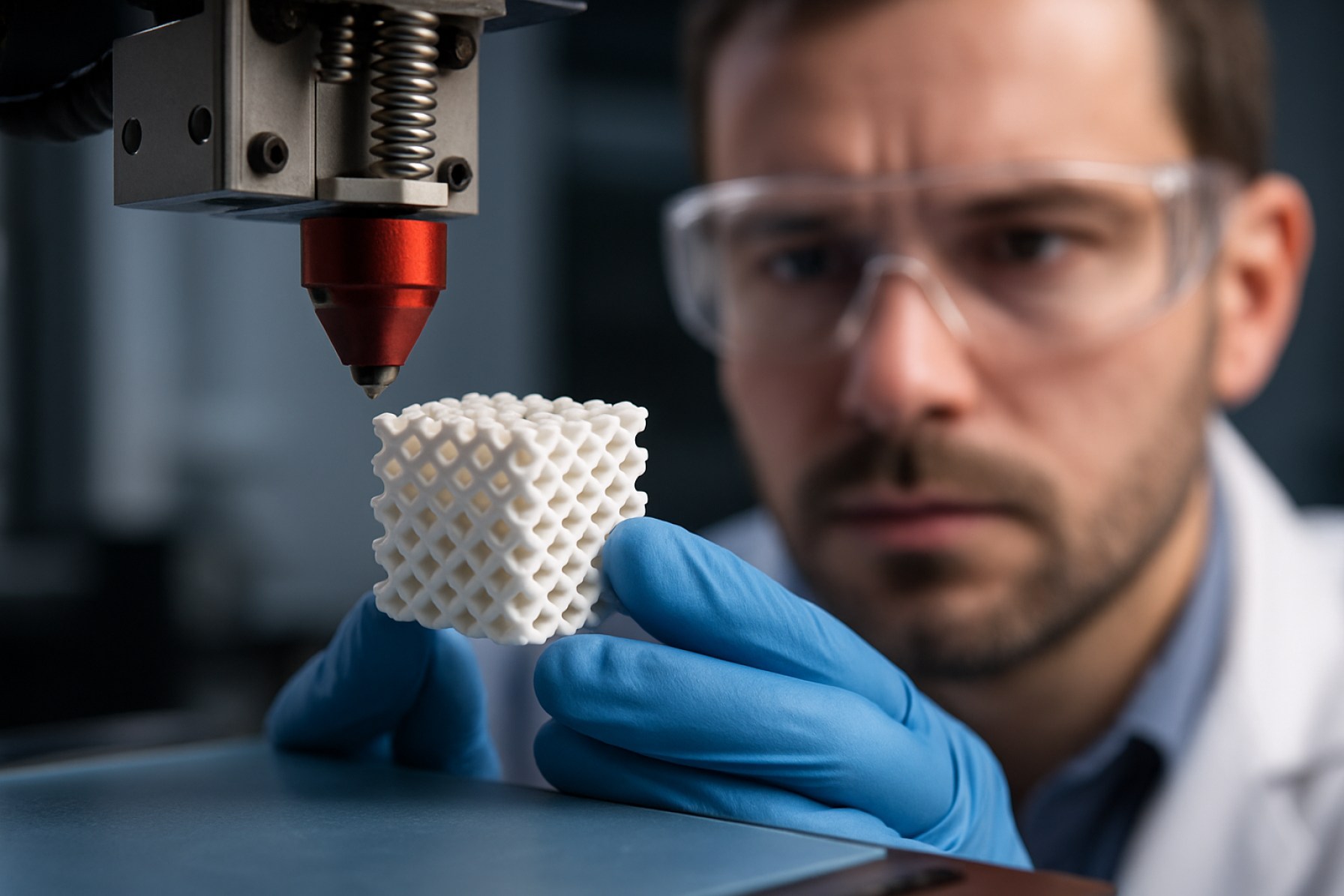

Zirconia ceramic additive manufacturing (AM) is poised for significant growth in 2025, driven by advances in material science, process optimization, and expanding industrial adoption. Zirconia, known for its exceptional mechanical strength, fracture toughness, and biocompatibility, is increasingly utilized in sectors such as dental, medical, aerospace, and electronics. The convergence of these properties with the design freedom of AM is enabling the production of complex, high-performance components that were previously unattainable with traditional manufacturing methods.

Key trends in 2025 include the maturation of powder-based and slurry-based AM processes, such as stereolithography (SLA), digital light processing (DLP), and binder jetting, specifically tailored for zirconia ceramics. Leading manufacturers like 3D Systems and Lithoz GmbH have expanded their portfolios to include dedicated zirconia-compatible printers and materials, supporting both prototyping and end-use part production. Lithoz GmbH, for example, has reported increased demand for its LCM (Lithography-based Ceramic Manufacturing) technology, which enables the fabrication of dense, high-precision zirconia parts for dental and industrial applications.

The dental sector remains a primary driver, with zirconia AM enabling the rapid, customized production of crowns, bridges, and implants. Companies such as CeramTec and 3DCeram are actively developing solutions to meet the stringent requirements of dental restorations, including translucency and biocompatibility. In parallel, the medical device industry is leveraging zirconia’s bioinertness for orthopedic and surgical components, with ongoing collaborations between AM system providers and healthcare manufacturers.

Aerospace and electronics are emerging as high-growth segments, as zirconia’s thermal and electrical insulation properties are harnessed for lightweight, complex geometries in engine components and electronic substrates. CeramTec and 3DCeram are among the companies expanding their offerings to address these applications, focusing on scalability and repeatability.

Looking ahead, the outlook for zirconia ceramic AM is robust. Ongoing R&D is expected to further improve material formulations, process reliability, and post-processing techniques, reducing costs and broadening adoption. Strategic partnerships between AM technology providers and end-users are anticipated to accelerate qualification and certification processes, particularly in regulated industries. As a result, zirconia ceramic AM is set to transition from niche prototyping to mainstream production across multiple sectors in the coming years.

Market Size, Growth Rate, and Forecasts to 2030

The global market for zirconia ceramic additive manufacturing (AM) is experiencing robust growth, driven by increasing demand for high-performance ceramics in sectors such as dental, medical, electronics, and aerospace. As of 2025, the market is characterized by a surge in adoption of advanced AM technologies—such as stereolithography (SLA), digital light processing (DLP), and binder jetting—capable of processing zirconia powders and slurries into complex, high-precision components. Leading manufacturers and technology providers, including 3D Systems, XJet, and Lithoz, have expanded their portfolios to include dedicated zirconia AM solutions, reflecting the material’s growing importance in additive manufacturing.

Recent years have seen a marked increase in the installed base of zirconia-capable AM systems, particularly in Europe and Asia-Pacific, where dental and medical device production is a key driver. For example, Lithoz has reported significant growth in the deployment of its LCM (Lithography-based Ceramic Manufacturing) systems for dental zirconia applications, while XJet continues to expand its global customer base for its NanoParticle Jetting technology, which enables the production of dense, high-purity zirconia parts. 3D Systems has also announced new partnerships and material launches targeting the dental and industrial sectors, further accelerating market penetration.

Market data from industry sources and company disclosures indicate that the zirconia ceramic AM segment is expected to achieve a compound annual growth rate (CAGR) exceeding 20% through 2030, outpacing the broader ceramic AM market. This growth is underpinned by ongoing advancements in material formulations, printer hardware, and post-processing techniques, which are reducing costs and improving part quality. The dental sector remains the largest end-user, with zirconia crowns, bridges, and implants produced via AM gaining regulatory acceptance and commercial traction. Additionally, the electronics and aerospace industries are beginning to adopt zirconia AM for specialized components requiring exceptional thermal and mechanical properties.

Looking ahead to 2030, the outlook for zirconia ceramic additive manufacturing is highly positive. Key players such as Lithoz, XJet, and 3D Systems are expected to continue driving innovation, while new entrants and collaborations are likely to emerge as the technology matures. The market is anticipated to benefit from further integration into digital manufacturing workflows, increased automation, and the development of multi-material AM systems, positioning zirconia ceramics as a cornerstone of next-generation additive manufacturing solutions.

Technological Innovations in Zirconia Ceramic 3D Printing

Zirconia ceramic additive manufacturing (AM) is experiencing rapid technological advancements as the sector enters 2025, driven by the demand for high-performance ceramics in medical, dental, and industrial applications. Zirconia’s exceptional mechanical strength, biocompatibility, and thermal stability make it a preferred material for 3D printing complex, high-precision components.

One of the most significant innovations is the refinement of vat photopolymerization and binder jetting processes tailored for zirconia. Companies such as Lithoz GmbH have pioneered LCM (Lithography-based Ceramic Manufacturing), enabling the production of dense, high-resolution zirconia parts with intricate geometries. Their systems are widely adopted in dental and medical device manufacturing, where accuracy and material properties are critical. Similarly, 3DCeram has advanced stereolithography (SLA) for technical ceramics, offering turnkey solutions for industrial-scale zirconia part production.

Material development is another area of focus. CeramTec, a global leader in advanced ceramics, has expanded its portfolio to include zirconia powders and feedstocks optimized for additive manufacturing, supporting both prototyping and end-use part production. The company’s expertise in ceramic materials science is helping to address challenges such as shrinkage control, sintering optimization, and achieving near-theoretical density in printed parts.

In 2025, hybrid manufacturing approaches are gaining traction, combining additive and subtractive techniques to enhance surface finish and dimensional accuracy. XJet has commercialized its NanoParticle Jetting™ technology, which enables the printing of zirconia with fine feature resolution and minimal post-processing. This technology is being adopted in sectors requiring complex, miniaturized ceramic components, such as electronics and medical implants.

Automation and digital workflow integration are also advancing. Companies are developing software solutions for process simulation, in-situ monitoring, and quality assurance, reducing the trial-and-error traditionally associated with ceramic AM. These digital tools are expected to accelerate the adoption of zirconia 3D printing in regulated industries by ensuring repeatability and traceability.

Looking ahead, the outlook for zirconia ceramic additive manufacturing is robust. The convergence of improved printing hardware, advanced materials, and digital process control is expected to drive broader industrialization. As more companies invest in dedicated zirconia AM platforms and as standards mature, the technology is poised to move from prototyping to serial production in dental, medical, and high-tech engineering fields over the next few years.

Competitive Landscape: Leading Players and Strategic Initiatives

The competitive landscape of zirconia ceramic additive manufacturing (AM) in 2025 is characterized by a dynamic mix of established ceramics specialists, advanced AM technology providers, and emerging startups. The sector is witnessing intensified activity as companies seek to address the growing demand for high-performance ceramic components in industries such as dental, medical, aerospace, and electronics.

Among the leading players, 3D Systems stands out for its investment in ceramic AM, particularly through its Figure 4 platform, which supports high-precision dental and medical applications. The company has expanded its material portfolio to include zirconia-based resins, targeting the dental prosthetics market. Similarly, XJet has made significant strides with its NanoParticle Jetting™ technology, enabling the production of complex zirconia parts with high density and fine detail. XJet’s installations in Europe and Asia are supporting both prototyping and end-use part production, with a focus on dental and industrial applications.

European ceramics leader CeramTec is leveraging its deep expertise in advanced ceramics to develop AM-ready zirconia powders and collaborate with printer manufacturers. CeramTec’s strategic partnerships aim to accelerate the adoption of zirconia AM in medical implants and wear-resistant components. Another notable player, Lithoz, specializes in lithography-based ceramic manufacturing (LCM) and has established itself as a key supplier of both printers and zirconia materials. Lithoz’s systems are widely used in research and industry for producing dense, high-strength zirconia parts, and the company is actively expanding its global distribution network.

In Asia, Tosoh Corporation is a major supplier of high-purity zirconia powders tailored for additive manufacturing. Tosoh collaborates with printer manufacturers and end-users to optimize powder properties for binder jetting and stereolithography processes, supporting the development of next-generation dental and industrial components.

Strategic initiatives in 2025 include joint ventures, material qualification programs, and investments in scalable production. Companies are focusing on improving throughput, reducing costs, and ensuring regulatory compliance, especially for medical and dental applications. The outlook for the next few years points to increased adoption of zirconia AM as process reliability improves and new applications emerge. Ongoing R&D, coupled with cross-industry collaborations, is expected to further expand the competitive landscape and drive innovation in zirconia ceramic additive manufacturing.

Applications Across Medical, Aerospace, and Industrial Sectors

Zirconia ceramic additive manufacturing (AM) is rapidly advancing as a transformative technology across medical, aerospace, and industrial sectors in 2025, driven by the unique properties of zirconia—such as high fracture toughness, chemical inertness, and biocompatibility. The adoption of zirconia AM is being accelerated by improvements in powder quality, binder jetting, and stereolithography-based processes, enabling the production of complex geometries and customized components that were previously unattainable with traditional manufacturing.

In the medical sector, zirconia AM is revolutionizing dental and orthopedic applications. Dental crowns, bridges, and implants benefit from zirconia’s superior aesthetics and mechanical strength. Companies like 3D Systems and CeramTec are actively developing and supplying zirconia-based AM solutions for dental laboratories and clinics, with a focus on patient-specific prosthetics and rapid turnaround. The ability to print intricate lattice structures and porous surfaces is also enhancing osseointegration in orthopedic implants, a trend expected to grow as regulatory approvals for AM-produced medical devices expand.

In aerospace, the demand for lightweight, high-temperature-resistant components is fueling the integration of zirconia AM. The material’s thermal stability and resistance to wear make it ideal for components such as turbine blades, thermal barrier coatings, and sensor housings. GE and Safran are among the aerospace leaders exploring ceramic AM for next-generation propulsion systems and engine parts, aiming to reduce weight and improve fuel efficiency. The ability to produce complex cooling channels and internal features via AM is particularly valuable for optimizing thermal management in jet engines.

Industrial applications are also expanding, with zirconia AM being used for wear-resistant tooling, chemical processing equipment, and electronic substrates. XJet and Lithoz are notable for their advanced ceramic AM platforms, which are being adopted by manufacturers seeking to reduce lead times and enable rapid prototyping of high-performance ceramic parts. The chemical and electronics industries are leveraging zirconia’s corrosion resistance and electrical insulation properties for custom components and small-batch production.

Looking ahead, the outlook for zirconia ceramic AM is robust. Ongoing investments in printer technology, material development, and post-processing are expected to further lower costs and expand the range of applications. As more companies validate the reliability and repeatability of zirconia AM parts, adoption is projected to accelerate, particularly in regulated sectors like medical and aerospace, where customization and performance are critical.

Supply Chain Dynamics and Raw Material Sourcing

The supply chain for zirconia ceramic additive manufacturing (AM) is evolving rapidly in 2025, shaped by both technological advances and global material sourcing dynamics. Zirconia (zirconium dioxide, ZrO₂) is prized for its exceptional mechanical strength, thermal stability, and biocompatibility, making it a critical material for AM in sectors such as dental, medical, and industrial components. The supply chain begins with the mining and processing of zircon sand, primarily sourced from Australia, South Africa, and China, which are the world’s leading producers of zirconium minerals.

Key players in the zirconia powder market include Tosoh Corporation, a Japanese chemical and specialty materials company, and Saint-Gobain, a global leader in advanced ceramics. Both companies supply high-purity zirconia powders tailored for additive manufacturing processes such as stereolithography (SLA), binder jetting, and material extrusion. Tosoh Corporation in particular has expanded its production capacity and developed specialized grades of yttria-stabilized zirconia (YSZ) to meet the stringent requirements of AM applications.

On the AM hardware side, companies like 3DCeram (France) and Lithoz (Austria) have established themselves as leaders in ceramic 3D printing, offering printers and proprietary zirconia-based materials. These companies often collaborate directly with powder suppliers to ensure consistent quality and supply, reducing the risk of disruptions. Lithoz has also invested in R&D to optimize the printability and sintering behavior of zirconia powders, further integrating the supply chain from raw material to finished part.

In 2025, the zirconia AM supply chain faces several challenges and opportunities. Geopolitical tensions and environmental regulations are impacting the mining and export of zircon sand, particularly from Australia and China. This has prompted manufacturers to diversify sourcing and invest in recycling and alternative feedstocks. At the same time, demand for zirconia AM parts is rising, especially in dental and medical markets, driving investments in local powder production and vertical integration. For example, Saint-Gobain is expanding its European operations to shorten supply chains and improve responsiveness.

Looking ahead, the outlook for zirconia ceramic AM supply chains is cautiously optimistic. Industry leaders are focusing on sustainability, traceability, and digitalization to enhance resilience. Strategic partnerships between powder producers, printer manufacturers, and end-users are expected to deepen, ensuring a more robust and agile supply network as the adoption of zirconia AM accelerates through 2025 and beyond.

Regulatory Environment and Industry Standards

The regulatory environment and industry standards for zirconia ceramic additive manufacturing (AM) are evolving rapidly as the technology matures and finds broader adoption in sectors such as dental, medical, and aerospace. In 2025, the focus is on harmonizing material specifications, process validation, and quality assurance to ensure safety, reliability, and interoperability across global markets.

Zirconia ceramics, prized for their biocompatibility, mechanical strength, and chemical stability, are increasingly produced via AM methods such as stereolithography (SLA), digital light processing (DLP), and binder jetting. Regulatory frameworks are being shaped by the requirements of end-use industries. For example, in dental and medical applications, zirconia AM parts must comply with stringent standards for biocompatibility and mechanical performance. The International Organization for Standardization (ISO) and the ASTM International have published standards such as ISO 13356 (for implantable zirconia ceramics) and ASTM F2792 (terminology for AM), which are increasingly referenced in regulatory submissions and procurement specifications.

In the European Union, the Medical Device Regulation (MDR 2017/745) requires manufacturers of zirconia AM dental and orthopedic implants to demonstrate conformity through rigorous testing and documentation. Similarly, the U.S. Food and Drug Administration (FDA) has issued guidance for additive manufacturing of medical devices, emphasizing process validation, traceability, and risk management. Leading AM system providers such as 3D Systems and Stratasys are actively engaging with regulatory bodies to ensure their zirconia-capable platforms meet these evolving requirements.

Industry consortia and standards bodies are also working to address the unique challenges of ceramic AM, such as powder characterization, sintering protocols, and post-processing. The CeramTec Group, a major supplier of technical ceramics, is involved in collaborative efforts to define best practices for additive manufacturing of zirconia components. Meanwhile, the TÜV Rheinland and other notified bodies are expanding their certification services to include AM-specific audits and material traceability for ceramics.

Looking ahead, the next few years will likely see the publication of more detailed standards tailored to zirconia AM, including guidelines for in-process monitoring, digital workflow validation, and lifecycle management. As regulatory clarity improves, adoption in regulated industries is expected to accelerate, with manufacturers investing in compliance infrastructure and digital quality management systems to streamline certification and market access.

Challenges: Technical Barriers and Adoption Hurdles

Zirconia ceramic additive manufacturing (AM) has made significant strides in recent years, but several technical barriers and adoption hurdles remain as of 2025. One of the primary challenges is the intrinsic difficulty of processing zirconia due to its high melting point, brittleness, and sensitivity to thermal gradients. These material properties complicate the use of common AM techniques such as selective laser sintering (SLS) and stereolithography (SLA), often resulting in residual stresses, microcracking, or incomplete densification. Achieving full density and optimal mechanical properties typically requires post-processing steps like high-temperature sintering, which can introduce further distortion or grain growth, limiting the precision and scalability of the process.

Another significant technical barrier is the formulation of printable zirconia feedstocks. For powder-based processes, the particle size distribution, purity, and flowability of zirconia powders are critical for consistent layer deposition and sintering. Binder jetting and material extrusion methods require the development of stable, high-solid-loading slurries or pastes, which must balance printability with the need to minimize shrinkage and porosity during debinding and sintering. Companies such as 3DCeram and Lithoz have developed proprietary feedstock formulations and process controls to address these issues, but widespread standardization is still lacking.

Adoption hurdles also stem from the high cost of zirconia powders and the specialized equipment required for ceramic AM. The capital investment for industrial-grade ceramic 3D printers, such as those offered by XJet and CeramTec, remains substantial, limiting accessibility for small and medium-sized enterprises. Furthermore, the lack of established design guidelines, process standards, and quality assurance protocols for zirconia AM parts creates uncertainty for end-users in critical sectors like dental, medical, and aerospace.

Despite these challenges, the outlook for zirconia ceramic AM is cautiously optimistic. Ongoing R&D efforts are focused on improving feedstock formulations, refining process parameters, and developing in-situ monitoring technologies to enhance part quality and reliability. Industry collaborations and standardization initiatives, such as those led by CeramTec and Lithoz, are expected to accelerate the adoption of zirconia AM in the next few years. As the technology matures, reductions in material and equipment costs, coupled with greater process automation, are likely to lower barriers to entry and expand the range of industrial applications.

Sustainability and Environmental Impact

Zirconia ceramic additive manufacturing (AM) is gaining momentum in 2025 as a sustainable alternative to traditional ceramic processing, driven by the need for resource efficiency and reduced environmental impact. The AM process, particularly powder bed fusion and stereolithography, enables near-net-shape production, minimizing material waste compared to subtractive manufacturing. This is especially significant for zirconia, a high-value ceramic used in medical, dental, and industrial applications.

Key industry players such as 3D Systems, XJet, and Lithoz are actively developing and commercializing zirconia AM solutions. Lithoz, for example, has highlighted the sustainability benefits of its LCM (Lithography-based Ceramic Manufacturing) technology, which allows for the production of complex zirconia parts with minimal support structures and high material utilization. This reduces both raw material consumption and post-processing waste.

Energy consumption is another critical factor in the environmental assessment of zirconia AM. While sintering remains energy-intensive, the overall energy footprint can be lower than traditional methods due to the elimination of multiple machining and firing steps. Companies like XJet are investing in process optimization to further reduce energy requirements, leveraging their NanoParticle Jetting technology to produce dense zirconia parts at lower temperatures and with less waste.

Recycling and circularity are emerging themes in 2025. Some manufacturers are exploring closed-loop systems for unused zirconia powders, enabling the recovery and reuse of materials within the production cycle. 3D Systems and Lithoz have both reported ongoing research into powder recycling protocols, aiming to further reduce the environmental footprint of their AM processes.

Looking ahead, the outlook for sustainability in zirconia ceramic AM is positive. The sector is expected to benefit from advances in binder chemistry, energy-efficient sintering, and digital process control, all of which contribute to greener manufacturing. Regulatory pressures and customer demand for sustainable products are likely to accelerate the adoption of these technologies. As more companies invest in life cycle assessments and eco-design, zirconia AM is poised to become a benchmark for sustainable advanced ceramics manufacturing in the coming years.

Future Outlook: Opportunities and Strategic Recommendations

The future outlook for zirconia ceramic additive manufacturing (AM) in 2025 and the following years is marked by significant opportunities and strategic imperatives for stakeholders across the value chain. As industries increasingly demand high-performance ceramics for applications in medical, dental, aerospace, and electronics, zirconia’s unique combination of mechanical strength, biocompatibility, and thermal stability positions it as a material of choice for advanced AM solutions.

Key industry players are actively expanding their portfolios and production capacities to address this growing demand. 3D Systems and Stratasys have both announced ongoing investments in ceramic AM technologies, with a focus on optimizing process reliability and material properties for end-use parts. XJet, recognized for its NanoParticle Jetting technology, continues to push the boundaries of high-resolution zirconia printing, targeting dental and medical device markets. Meanwhile, Lithoz is expanding its global reach, leveraging its LCM (Lithography-based Ceramic Manufacturing) process to deliver dense, complex zirconia components for both prototyping and serial production.

The dental sector remains a primary driver, with digital dentistry workflows increasingly integrating zirconia AM for crowns, bridges, and implants. Companies such as CeramTec and Ivoclar are collaborating with AM technology providers to streamline the transition from digital design to finished ceramic restorations, reducing lead times and enabling mass customization. In parallel, the electronics and aerospace industries are exploring zirconia’s potential for high-temperature and insulating components, with CoorsTek and Kyocera investing in R&D to adapt AM processes for these demanding applications.

Looking ahead, the next few years will likely see:

- Broader adoption of multi-material and hybrid AM systems, enabling the integration of zirconia with metals or polymers for multifunctional parts.

- Advancements in feedstock development, including improved zirconia powders and printable pastes, to enhance part density and surface finish.

- Greater emphasis on process automation, in-situ monitoring, and quality assurance to meet stringent regulatory and industrial standards.

- Strategic partnerships between AM technology developers, material suppliers, and end-users to accelerate application-specific innovation.

To capitalize on these opportunities, stakeholders should prioritize investment in R&D, workforce training, and cross-sector collaboration. Establishing robust supply chains for high-purity zirconia and fostering open innovation ecosystems will be critical for scaling up production and unlocking new markets. As the technology matures, zirconia ceramic AM is poised to become a cornerstone of advanced manufacturing, delivering value through design freedom, performance, and sustainability.

Sources & References

- 3D Systems

- Lithoz GmbH

- CeramTec

- 3DCeram

- XJet

- GE

- International Organization for Standardization

- ASTM International

- Stratasys

- TÜV Rheinland

- Ivoclar

- Kyocera