Ultrafast Terahertz Radiation Imaging Systems in 2025: Transforming Non-Destructive Testing, Security, and Medical Diagnostics. Explore the Next 5 Years of Rapid Innovation and Market Expansion.

- Executive Summary: 2025 Market Landscape and Key Drivers

- Technology Overview: Principles of Ultrafast Terahertz Radiation Imaging

- Current Market Size and 2025–2030 Growth Forecasts

- Key Applications: Security, Medical, Industrial, and Scientific Uses

- Competitive Landscape: Leading Companies and Strategic Initiatives

- Recent Breakthroughs: Innovations in Sources, Detectors, and Imaging Techniques

- Regulatory Environment and Industry Standards

- Challenges: Technical Barriers, Cost, and Adoption Hurdles

- Emerging Opportunities: AI Integration, Miniaturization, and New Markets

- Future Outlook: Market Growth Trajectory and Disruptive Trends (2025–2030)

- Sources & References

Executive Summary: 2025 Market Landscape and Key Drivers

The market for ultrafast terahertz (THz) radiation imaging systems is poised for significant growth in 2025, driven by rapid advancements in photonics, semiconductor technologies, and increasing demand across sectors such as security screening, non-destructive testing, and biomedical imaging. Terahertz imaging, which operates in the frequency range between microwave and infrared, offers unique capabilities such as non-ionizing, high-resolution, and material-specific imaging, making it highly attractive for both industrial and research applications.

Key drivers in 2025 include the miniaturization and integration of THz sources and detectors, enabling more compact and cost-effective systems. Companies like TOPTICA Photonics and Menlo Systems are at the forefront, offering femtosecond laser-based THz sources and turnkey imaging platforms. These systems are increasingly being adopted in quality control for advanced manufacturing, where they enable real-time, non-contact inspection of multilayer structures and detection of hidden defects.

In the security sector, the ability of THz imaging to penetrate clothing and packaging without harmful radiation is accelerating deployment at airports and border checkpoints. TeraSense Group and Advantest Corporation are notable for their development of high-speed, room-temperature THz cameras and scanners, which are being piloted in various security and industrial environments. The push for higher frame rates and larger imaging areas is expected to continue, with new systems targeting real-time throughput for conveyor-based inspection and public safety applications.

Biomedical imaging is another area of rapid progress, with ultrafast THz systems enabling label-free, high-contrast imaging of tissues and biomolecules. Research collaborations and pilot deployments are underway, with companies such as TOPTICA Photonics supporting academic and clinical research into cancer detection and tissue characterization. The non-ionizing nature of THz radiation is a key advantage, addressing safety concerns associated with X-ray and other modalities.

Looking ahead, the market outlook for 2025 and the following years is shaped by ongoing improvements in THz source power, detector sensitivity, and system integration. The emergence of CMOS-compatible THz components and the adoption of AI-driven image analysis are expected to further expand the addressable market. Industry leaders are investing in scalable manufacturing and global distribution, with TOPTICA Photonics, Menlo Systems, and TeraSense Group positioned as key innovators. As regulatory frameworks evolve and costs decline, ultrafast THz imaging is set to transition from niche research to mainstream industrial and medical adoption.

Technology Overview: Principles of Ultrafast Terahertz Radiation Imaging

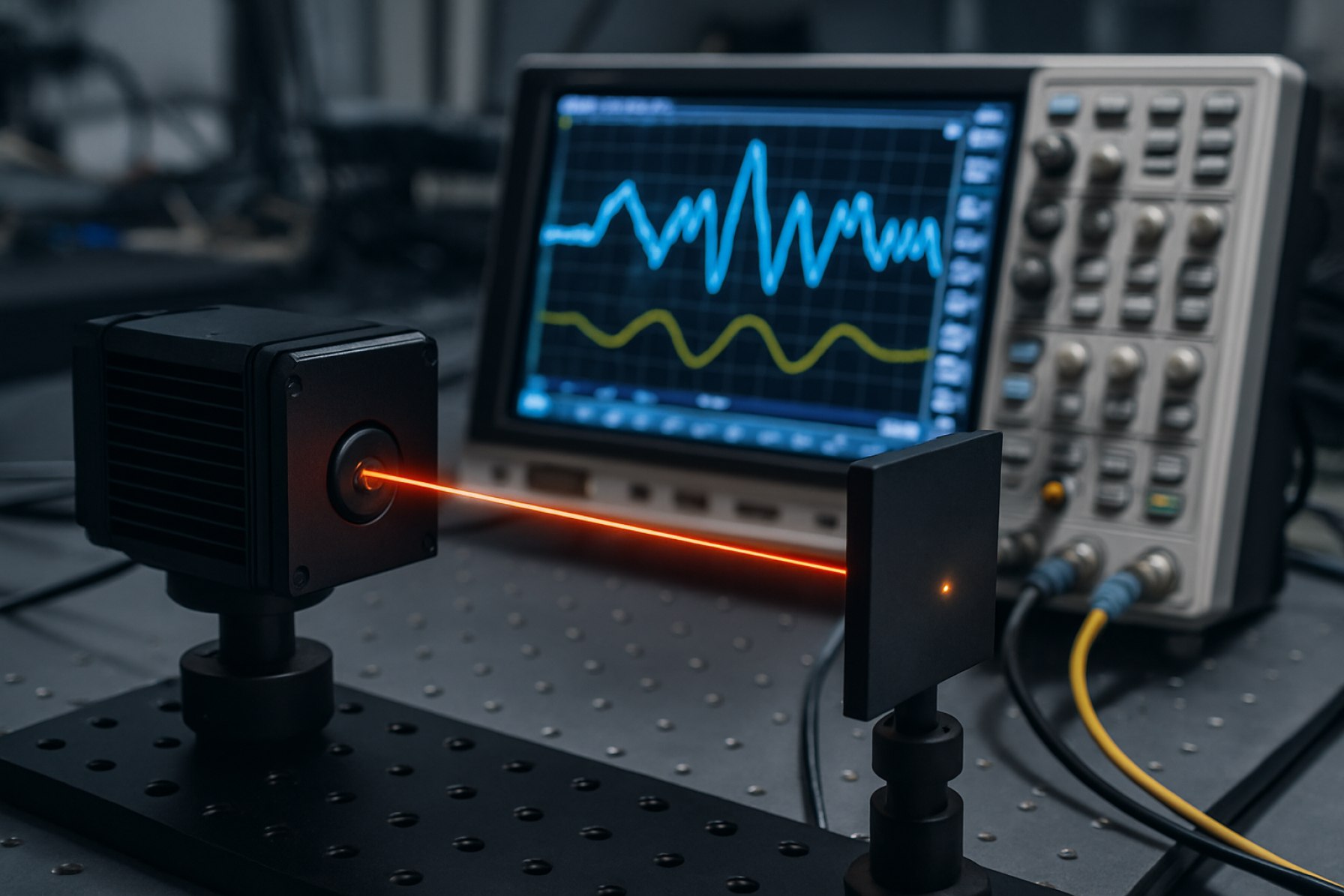

Ultrafast terahertz (THz) radiation imaging systems leverage the unique properties of electromagnetic waves in the terahertz frequency range (0.1–10 THz) to enable non-invasive, high-resolution imaging of materials and biological tissues. The core principle involves generating and detecting ultrashort THz pulses—typically on the order of femtoseconds to picoseconds—using advanced photonic and electronic techniques. These pulses interact with the sample, and the transmitted or reflected THz signals are captured to reconstruct images that reveal structural, chemical, and electronic information inaccessible to conventional imaging modalities.

In 2025, the most prevalent ultrafast THz imaging systems are based on time-domain spectroscopy (THz-TDS), where femtosecond lasers generate broadband THz pulses via photoconductive antennas or nonlinear optical crystals. The detection is achieved through coherent sampling, allowing for both amplitude and phase information to be recorded with sub-picosecond temporal resolution. This enables not only high spatial resolution but also the ability to perform spectroscopic analysis at each pixel, a key advantage for applications in material characterization, security screening, and biomedical diagnostics.

Recent advances have focused on improving the speed, sensitivity, and scalability of these systems. Leading manufacturers such as TOPTICA Photonics and Menlo Systems have introduced turnkey THz-TDS platforms with integrated femtosecond fiber lasers, compact photoconductive antennas, and automated scanning stages. These systems are capable of real-time imaging at video frame rates, a significant leap from earlier generations that required minutes per image. TOPTICA Photonics, for example, offers modular systems that can be tailored for transmission, reflection, or even near-field imaging, supporting both research and industrial deployment.

Another technological trend is the integration of microelectronic and photonic components to miniaturize THz sources and detectors. Companies like TeraVil and BATOP are developing compact, high-power THz emitters and fast detectors, enabling portable and field-deployable imaging solutions. These advances are expected to drive adoption in quality control, non-destructive testing, and security sectors over the next few years.

Looking ahead, the outlook for ultrafast THz imaging systems is shaped by ongoing improvements in laser technology, detector sensitivity, and data processing algorithms. The convergence of artificial intelligence with THz imaging is anticipated to further enhance image reconstruction and interpretation, opening new frontiers in medical diagnostics and industrial inspection. As system costs decrease and performance improves, ultrafast THz imaging is poised to transition from specialized research labs to broader commercial and clinical applications by the late 2020s.

Current Market Size and 2025–2030 Growth Forecasts

The market for ultrafast terahertz (THz) radiation imaging systems is experiencing a period of rapid evolution, driven by advances in photonics, semiconductor technology, and growing demand across sectors such as security screening, non-destructive testing, and biomedical imaging. As of 2025, the global market size for ultrafast THz imaging systems is estimated to be in the low hundreds of millions USD, with North America, Europe, and East Asia representing the largest regional markets. This growth is underpinned by increasing adoption in industrial quality control, pharmaceutical inspection, and research applications.

Key industry players include TOPTICA Photonics AG, a German company recognized for its high-performance terahertz sources and detectors, and Menlo Systems GmbH, which specializes in femtosecond laser-based THz systems. In the United States, TOPTICA Photonics, Inc. and TeraSense Group, Inc. are notable for their compact, scalable THz imaging solutions. In Asia, Hamamatsu Photonics K.K. of Japan is a major supplier of THz detectors and imaging modules, while Advantest Corporation is expanding its portfolio to include THz inspection systems for semiconductor and electronics manufacturing.

From 2025 to 2030, the ultrafast THz imaging market is projected to grow at a compound annual growth rate (CAGR) in the range of 20–30%, outpacing many other photonics segments. This robust expansion is attributed to several factors:

- Continued miniaturization and cost reduction of THz sources and detectors, making systems more accessible for industrial and medical users.

- Regulatory encouragement for non-ionizing, non-destructive imaging in security and healthcare, favoring THz over X-ray in certain applications.

- Emergence of new application areas, such as in-line process monitoring in advanced manufacturing and high-throughput screening in pharmaceuticals.

- Increased investment in R&D by both established photonics companies and startups, particularly in the US, Germany, Japan, and China.

Looking ahead, the market is expected to see further consolidation as leading companies expand their product portfolios and form strategic partnerships. For example, TOPTICA Photonics AG and Hamamatsu Photonics K.K. are both investing in next-generation ultrafast THz systems with higher sensitivity and broader bandwidths, targeting applications in semiconductor inspection and biomedical diagnostics. The outlook for 2025–2030 is one of strong double-digit growth, with the potential for the market to surpass $1 billion by the end of the decade as adoption accelerates across multiple high-value sectors.

Key Applications: Security, Medical, Industrial, and Scientific Uses

Ultrafast terahertz (THz) radiation imaging systems are rapidly advancing, with 2025 poised to see significant expansion in their deployment across security, medical, industrial, and scientific sectors. These systems leverage the unique properties of THz waves—such as their ability to penetrate non-conductive materials and provide spectroscopic information—to deliver non-invasive, high-resolution imaging at unprecedented speeds.

In security, THz imaging is increasingly adopted for screening applications at airports, border crossings, and critical infrastructure. Unlike X-rays, THz radiation is non-ionizing, making it safer for frequent use. Leading manufacturers such as TOPTICA Photonics and Menlo Systems are supplying ultrafast THz sources and detectors that enable real-time detection of concealed weapons, explosives, and contraband, even through clothing or packaging. The ability to distinguish between different materials based on their spectral signatures is a key advantage, and ongoing improvements in system speed and sensitivity are expected to further enhance throughput and reliability in high-traffic environments.

In the medical field, ultrafast THz imaging is being explored for non-invasive diagnostics, particularly in dermatology and oncology. The technology’s sensitivity to water content and molecular composition allows for early detection of skin cancers and assessment of burn injuries. Companies like TOPTICA Photonics and TeraView are actively developing medical-grade THz imaging platforms, with clinical trials underway to validate their efficacy and safety. Over the next few years, regulatory approvals and integration with existing diagnostic workflows are anticipated, potentially transforming early-stage cancer detection and tissue characterization.

Industrial applications are also expanding, with THz imaging systems being deployed for quality control, non-destructive testing, and process monitoring. The ability to image through packaging and composite materials is invaluable for sectors such as pharmaceuticals, aerospace, and electronics. TeraView and Menlo Systems are providing turnkey solutions for inline inspection, enabling manufacturers to detect defects, measure layer thickness, and ensure product integrity in real time. As system costs decrease and integration becomes more seamless, adoption is expected to accelerate.

In scientific research, ultrafast THz imaging is enabling breakthroughs in material science, chemistry, and biology. The technology’s ability to capture ultrafast dynamics at the molecular level is driving new discoveries in fields ranging from semiconductor physics to protein folding. Research institutions and national laboratories are collaborating with industry leaders to push the boundaries of spatial and temporal resolution, with the expectation that new imaging modalities and analytical techniques will emerge in the coming years.

Overall, the outlook for ultrafast THz radiation imaging systems in 2025 and beyond is highly promising, with ongoing innovation and cross-sector collaboration set to unlock new applications and drive widespread adoption.

Competitive Landscape: Leading Companies and Strategic Initiatives

The competitive landscape for ultrafast terahertz (THz) radiation imaging systems in 2025 is characterized by a dynamic interplay of established photonics leaders, specialized THz technology firms, and emerging startups. The sector is witnessing rapid innovation, driven by demand in security screening, non-destructive testing, semiconductor inspection, and biomedical imaging. Key players are investing in both hardware advancements and software integration to enhance imaging speed, resolution, and system robustness.

Among the global leaders, Thorlabs continues to expand its portfolio of THz components and imaging systems, leveraging its expertise in ultrafast lasers and optoelectronics. The company’s modular approach allows for flexible system configurations, catering to research and industrial applications. TOPTICA Photonics, another major player, is recognized for its high-performance femtosecond lasers and turnkey THz time-domain spectroscopy (TDS) systems, which are increasingly adopted in quality control and material characterization.

In the Asia-Pacific region, Hamamatsu Photonics stands out for its development of advanced THz detectors and sources, with a focus on integrating ultrafast electronics for real-time imaging. The company’s strategic collaborations with semiconductor manufacturers and research institutes are accelerating the commercialization of compact, high-speed THz imaging modules.

Specialized firms such as Menlo Systems are pushing the boundaries of ultrafast THz generation and detection, offering fiber-coupled systems that emphasize stability and ease of use. Their recent initiatives include partnerships with industrial automation companies to deploy THz imaging in inline inspection processes.

Emerging startups are also making significant inroads. For example, TeraView is pioneering portable THz imaging solutions for medical diagnostics and security, while Baker Hughes (through its acquisition of THz imaging technology) is exploring applications in energy infrastructure monitoring.

Strategic initiatives across the sector include increased investment in AI-driven image analysis, miniaturization of THz sources and detectors, and the development of multi-modal imaging platforms. Industry alliances and public-private partnerships are fostering standardization and interoperability, with organizations such as the Optica (formerly OSA) supporting collaborative research and knowledge exchange.

Looking ahead, the competitive landscape is expected to intensify as more companies enter the market and existing players scale up production. The convergence of ultrafast photonics, advanced materials, and intelligent software is poised to unlock new applications and drive broader adoption of THz imaging systems through 2025 and beyond.

Recent Breakthroughs: Innovations in Sources, Detectors, and Imaging Techniques

The field of ultrafast terahertz (THz) radiation imaging systems has witnessed significant breakthroughs in recent years, with 2025 marking a period of rapid innovation in sources, detectors, and imaging methodologies. These advances are driven by the demand for higher spatial and temporal resolution, real-time imaging capabilities, and broader application in sectors such as semiconductor inspection, biomedical diagnostics, and security screening.

On the source side, the development of compact, high-power, and broadband THz emitters has been a focal point. Notably, companies like TOPTICA Photonics and Menlo Systems have introduced turnkey fiber-laser-based THz sources that offer femtosecond pulse durations and high repetition rates, enabling real-time imaging at frame rates previously unattainable. These systems leverage advances in photoconductive antenna design and nonlinear optical crystals, resulting in improved efficiency and spectral coverage.

In parallel, detector technology has evolved to match the performance of new sources. Baker Hughes and Hamamatsu Photonics have both expanded their portfolios with ultrafast THz detectors based on low-noise, high-sensitivity materials such as graphene and novel semiconductor heterostructures. These detectors are capable of sub-picosecond temporal resolution, which is critical for capturing ultrafast phenomena in materials and biological tissues.

Imaging techniques have also seen transformative progress. The integration of computational imaging and machine learning algorithms with THz systems has enabled the reconstruction of high-fidelity images from sparse or noisy data, significantly reducing acquisition times. Companies like TOPTICA Photonics and Menlo Systems are actively developing software suites that harness these algorithms for real-time, 3D THz tomography and hyperspectral imaging.

A notable trend in 2025 is the miniaturization and ruggedization of THz imaging systems for field deployment. Advantest Corporation, a leader in semiconductor test equipment, has introduced portable THz imaging modules designed for inline inspection in manufacturing environments, offering sub-micron resolution and high throughput.

Looking ahead, the next few years are expected to bring further integration of THz systems with other modalities, such as X-ray and infrared, for multimodal imaging platforms. The ongoing collaboration between industry leaders and research institutions is poised to accelerate the commercialization of ultrafast THz imaging, expanding its reach into new markets and applications.

Regulatory Environment and Industry Standards

The regulatory environment and industry standards for ultrafast terahertz (THz) radiation imaging systems are rapidly evolving as the technology matures and finds broader applications in security screening, non-destructive testing, medical diagnostics, and semiconductor inspection. As of 2025, the primary regulatory focus is on safety, electromagnetic compatibility (EMC), and interoperability, with several international and national bodies actively shaping the landscape.

In the United States, the Federal Communications Commission (FCC) regulates the use of the electromagnetic spectrum, including the THz range (0.1–10 THz). The FCC has issued guidelines for experimental and commercial use of frequencies above 95 GHz, which directly impact the deployment of THz imaging systems. These guidelines address permissible emission levels, licensing requirements, and interference mitigation, ensuring that THz devices do not disrupt existing communications infrastructure.

Globally, the International Electrotechnical Commission (IEC) and the International Organization for Standardization (ISO) are leading efforts to develop harmonized standards for THz equipment. The IEC’s Technical Committee 86 (Fibre optics) and ISO’s Technical Committee 172 (Optics and photonics) are collaborating on standards that cover performance metrics, safety protocols, and testing methodologies for THz imaging systems. These standards are expected to be published incrementally over the next few years, providing a framework for manufacturers and end-users.

In Europe, the European Telecommunications Standards Institute (ETSI) is actively working on standards for high-frequency communications, including the THz band. ETSI’s work is particularly relevant for THz imaging systems used in security and industrial automation, as it addresses both spectrum allocation and device interoperability. The European Union’s Radio Equipment Directive (RED) also applies to THz devices, mandating CE marking and conformity assessment for products entering the European market.

Industry leaders such as TOPTICA Photonics, Menlo Systems, and Baker Hughes are actively participating in standardization initiatives and collaborating with regulatory bodies to ensure their ultrafast THz imaging products meet emerging requirements. These companies are also investing in compliance testing and certification, anticipating stricter enforcement as the market grows.

Looking ahead, the regulatory environment is expected to become more stringent as THz imaging systems proliferate in sensitive sectors such as healthcare and public safety. The next few years will likely see the introduction of more detailed exposure limits, data privacy guidelines for imaging applications, and cross-border harmonization of standards. Industry stakeholders are advised to closely monitor developments from the FCC, IEC, ISO, and ETSI to ensure ongoing compliance and market access.

Challenges: Technical Barriers, Cost, and Adoption Hurdles

Ultrafast terahertz (THz) radiation imaging systems are at the forefront of next-generation non-destructive testing, security screening, and biomedical diagnostics. However, as of 2025, several technical, economic, and adoption-related challenges continue to impede their widespread deployment.

Technical Barriers: The core technical challenge remains the generation and detection of broadband, high-power THz pulses with sufficient signal-to-noise ratio for real-time imaging. Most commercial systems rely on photoconductive antennas or nonlinear crystals, which are limited by low output power and sensitivity, especially at room temperature. Cryogenic cooling is often required for high-performance detectors, increasing system complexity and limiting portability. Furthermore, the spatial resolution of THz imaging is fundamentally constrained by the relatively long wavelengths (0.1–1 mm), making sub-millimeter feature detection difficult without advanced near-field techniques. Companies such as TOPTICA Photonics and Menlo Systems are actively developing compact, fiber-based THz sources and detectors, but achieving robust, high-throughput imaging in industrial environments remains a work in progress.

Cost Factors: The high cost of ultrafast lasers, precision optics, and sensitive detectors continues to be a major barrier. Complete THz imaging systems can range from $100,000 to over $500,000, depending on specifications and integration level. This price point restricts adoption to well-funded research institutions and select industrial users. Efforts to reduce costs focus on integrating semiconductor-based THz sources and detectors, as pursued by Advantest Corporation and TOPTICA Photonics, but mass production and economies of scale have yet to be realized.

Adoption Hurdles: Beyond technical and cost issues, market adoption is slowed by a lack of standardized protocols, limited user expertise, and regulatory uncertainties, especially in medical and security applications. The absence of universally accepted calibration standards complicates cross-system comparisons and quality assurance. Additionally, the relatively slow imaging speeds of current systems—often several seconds per frame—limit their utility in high-throughput industrial settings. Industry consortia and standardization bodies, such as the IEEE, are beginning to address these gaps, but widespread harmonization is still in its early stages.

Outlook: Over the next few years, incremental advances in photonic integration, detector sensitivity, and system miniaturization are expected. Companies like Menlo Systems and TOPTICA Photonics are investing in turnkey, user-friendly platforms aimed at broader markets. However, significant reductions in cost and improvements in speed and resolution will be necessary before ultrafast THz imaging systems achieve mainstream adoption across industries.

Emerging Opportunities: AI Integration, Miniaturization, and New Markets

The landscape for ultrafast terahertz (THz) radiation imaging systems is rapidly evolving in 2025, driven by advances in artificial intelligence (AI), miniaturization, and the opening of new application markets. These trends are reshaping both the technological capabilities and the commercial potential of THz imaging.

AI integration is a key enabler for next-generation THz imaging. Machine learning algorithms are increasingly being embedded into THz systems to enhance image reconstruction, automate defect detection, and enable real-time analysis. For example, leading THz system manufacturers such as TOPTICA Photonics and Menlo Systems are actively developing platforms that leverage AI for faster and more accurate material characterization and security screening. These AI-driven systems can process large datasets generated by ultrafast THz pulses, extracting subtle features that would be difficult to discern manually, thus improving throughput and reliability in industrial and biomedical settings.

Miniaturization is another transformative trend. The push towards compact, portable THz imaging devices is being realized through advances in photonic integration and semiconductor technologies. Companies like TOPTICA Photonics and TeraView are introducing smaller, more robust THz sources and detectors, making it feasible to deploy these systems outside specialized laboratories. This miniaturization is opening doors to in-field applications such as non-destructive testing in aerospace, on-site pharmaceutical quality control, and even handheld security scanners.

New market opportunities are emerging as the cost and complexity of THz systems decrease. In 2025 and the coming years, sectors such as automotive, food safety, and advanced manufacturing are expected to adopt THz imaging for quality assurance and process monitoring. For instance, TeraView is actively targeting the semiconductor industry with solutions for wafer inspection and failure analysis, while Menlo Systems is expanding into biomedical imaging and pharmaceutical analysis. The ability of THz radiation to penetrate non-conductive materials without ionizing damage makes it uniquely suited for these applications.

Looking ahead, the convergence of AI, miniaturization, and expanding market demand is expected to accelerate the adoption of ultrafast THz imaging systems. As more companies invest in R&D and as regulatory frameworks adapt, the next few years will likely see THz imaging transition from a niche technology to a mainstream tool across multiple industries.

Future Outlook: Market Growth Trajectory and Disruptive Trends (2025–2030)

The market for ultrafast terahertz (THz) radiation imaging systems is poised for significant transformation between 2025 and 2030, driven by rapid technological advancements, expanding application domains, and increasing investments from both public and private sectors. As of 2025, the sector is witnessing a shift from laboratory-scale prototypes to robust, commercially viable solutions, with key players accelerating the pace of innovation and deployment.

One of the most notable trends is the integration of ultrafast THz imaging into industrial quality control and non-destructive testing. Companies such as TOPTICA Photonics and Menlo Systems are at the forefront, offering turnkey THz imaging platforms that leverage femtosecond lasers and advanced detection schemes. These systems are increasingly being adopted in sectors like semiconductor inspection, automotive component analysis, and pharmaceutical quality assurance, where their ability to provide real-time, high-resolution, and non-contact imaging is highly valued.

In the medical and security domains, ultrafast THz imaging is expected to disrupt traditional modalities by enabling label-free, non-ionizing, and highly sensitive detection of biological tissues and concealed objects. Advantest Corporation and TeraView are actively developing portable and high-throughput THz imaging systems aimed at clinical diagnostics and security screening, respectively. These advancements are supported by ongoing collaborations with research institutions and government agencies, which are anticipated to accelerate regulatory approvals and market adoption over the next few years.

From a technological perspective, the next wave of innovation is centered on enhancing imaging speed, spatial resolution, and system miniaturization. The adoption of photonic integrated circuits, novel THz sources, and AI-driven image reconstruction algorithms is expected to lower system costs and expand accessibility. Companies like Hamamatsu Photonics are investing in the development of compact THz emitters and detectors, targeting integration into handheld and in-line industrial devices.

Looking ahead to 2030, the ultrafast THz imaging market is projected to experience robust growth, underpinned by the convergence of photonics, electronics, and data science. Strategic partnerships between equipment manufacturers, end-users, and research organizations will likely catalyze the emergence of new applications in areas such as advanced manufacturing, smart infrastructure monitoring, and personalized medicine. As technical barriers continue to fall and regulatory frameworks mature, ultrafast THz imaging is set to become a mainstream tool across multiple high-impact industries.

Sources & References

- TOPTICA Photonics

- Menlo Systems

- TeraSense Group

- Advantest Corporation

- Hamamatsu Photonics K.K.

- TeraView

- Thorlabs

- Baker Hughes

- International Organization for Standardization

- IEEE